Australians are flying within the country in numbers matching pre-pandemic demand, but the supply of domestic seats hasn’t quite caught up, according to the ACCC’s latest Domestic Airline Competition report.

In June 2025, the number of seats offered by major airlines was 2.8% lower than in June 2019. Both Qantas and Virgin Australia have boosted capacity since then, but Tigerair’s 2020 collapse left a gap in the market that hasn’t been fully filled. Regional carrier Rex has also reduced some services.

“The withdrawal of Tigerair in 2020 significantly reduced the capacity for low-cost travel from the domestic market,” ACCC Commissioner Anna Brakey said. She noted that slower growth in seat supply has likely meant travellers are paying more than they would in a more competitive market.

The report found that while jet fuel prices dropped 12.3% in the year to June 2025, average airfares remained slightly higher than a year earlier.

Fleet changes are on the horizon, with Qantas and Virgin Australia expecting new aircraft deliveries later this year after global supply chain delays. Qantas will also redeploy 13 aircraft from Jetstar Asia, which is closing, to Australian and New Zealand routes. Airlines have signalled these planes will first replace older or leased aircraft before expanding capacity.

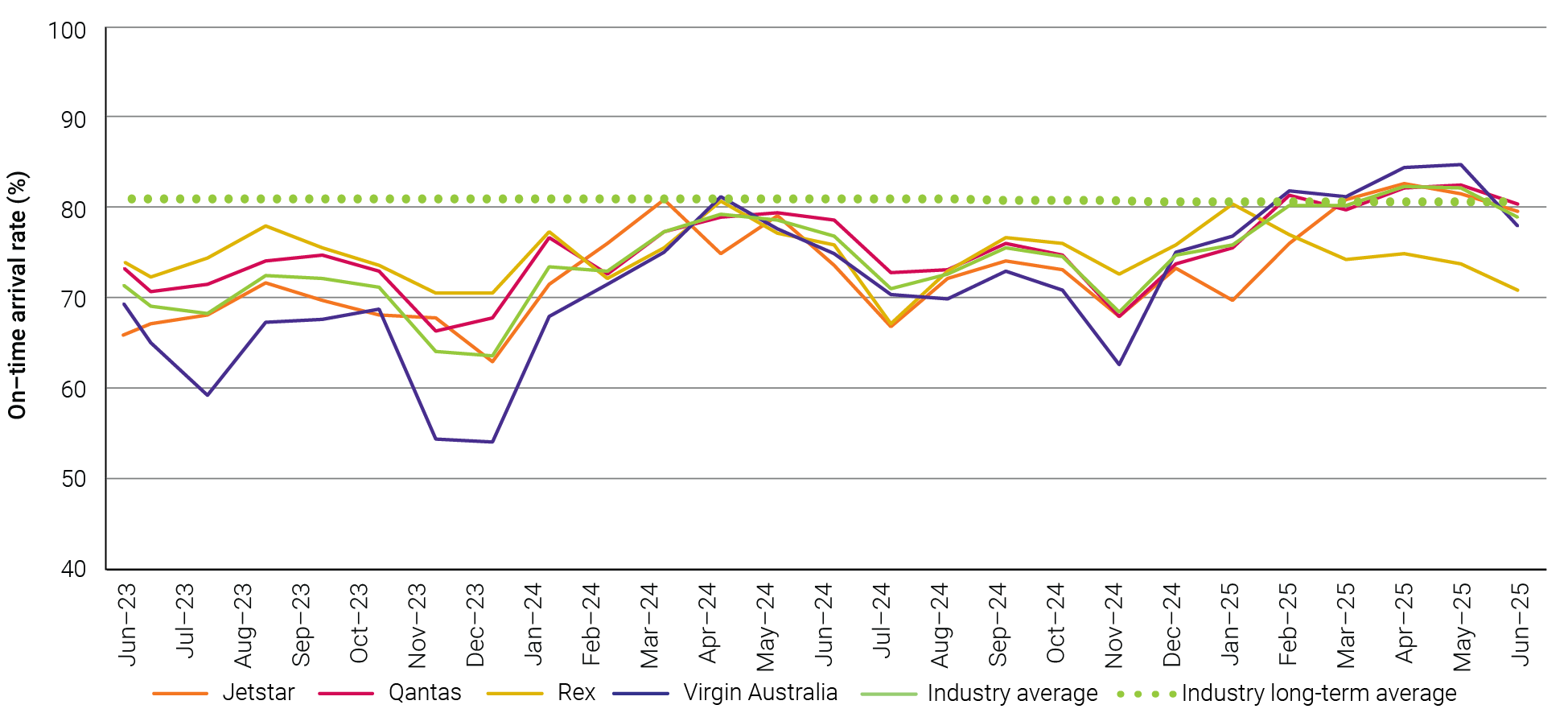

Reliability on the up

On-time performance for domestic flights hit a three-year high in April, with 82.4% of services arriving within 15 minutes of schedule. Jetstar, Qantas and Virgin all beat the long-term industry average of 80.7%. Virgin recorded the strongest results, with more than 84% of its flights arriving on time in both April and May — the best monthly performance by any airline since early 2022.

“This improvement in on-time performance is good news for travellers as they can have more confidence that their flight will arrive at their destination at the time they booked,” Ms Brakey said.

Cancellation rates also fell below the long-term industry average of 2.2% in April and May, before rising slightly to 2.4% in June. Virgin and Jetstar cancelled just 0.7% of flights in April. Qantas, however, continued to record higher cancellation rates than its competitors, averaging more than double the rate of Jetstar and Virgin in the June quarter.

Frequent flyer programs under the microscope

The ACCC also examined frequent flyer programs, which remain highly profitable for Qantas and Virgin. As of December 2024, Qantas Frequent Flyer had 17 million members, while Virgin’s Velocity program had 12.9 million.

While these schemes offer benefits such as upgrades, reward flights and lounge access, the ACCC cautioned travellers to weigh up the true value. Points may expire, lose value over time, or be difficult to redeem depending on availability. Airlines can also change the number of points or status credits needed for rewards.

“Consumers should consider how these programs operate and weigh the potential benefits of points or status credits against the cost of flights when choosing fares,” Ms Brakey said.

Industry monitoring

The ACCC resumed quarterly monitoring of domestic air travel in late 2023, focusing on prices, costs and profits. It collects data from Jetstar, Qantas, Rex and Virgin Australia.

Rex, which entered voluntary administration in July 2024, continues to operate regional flights with government support guaranteeing bookings.